Misconceptions regarding cryptocurrencies as an alternative to fiat

Caveat emptor.neofeudalreview.substack.com

I stumbled upon this the other day and encourage you guys to read it. It's a nice writeup on Tether that has links to several other even more detailed breakdowns. It's interesting that the author of this piece independently arrived at the same conclusion I've voiced in this thread previously - that Tether has been captured by the U.S. Deep State and is being used for laundering money, paying bribes to corrupt politicians and funding off-the-book black operations. Regardless whether or not that's true, it's clear that Tether is functioning as Bitcoin's own Federal Reserve, and has massively inflated the price over the past several years. If Tether implodes, the damage it will inflict on Bitcoin - and on the entire crypto ecosystem - will be incalculable. It's a ticking time bomb, and one that the Deep State can very likely detonate at will. Why would they do that? Well, it's much easier to sell and justify the introduction of a government-backed CBDC after Bitcoin and all other cryptos have essentially been destroyed in a controlled demolition.

A good article, @scorpion

You seem to think that Tether needs to be backed by USD, at 100%. What are your bank deposits backed by? Are they backed by USD at a ratio of 1:1? Not even close. They aren’t required to be backed 10:1 or even 100:1. Ironically, Tether probably has more backing than most FDIC banks in the US.

The HELOC I took out in order to buy Bitcoin: that money didn’t exist until the bank created the loan. I bought Bitcoin with nothing.

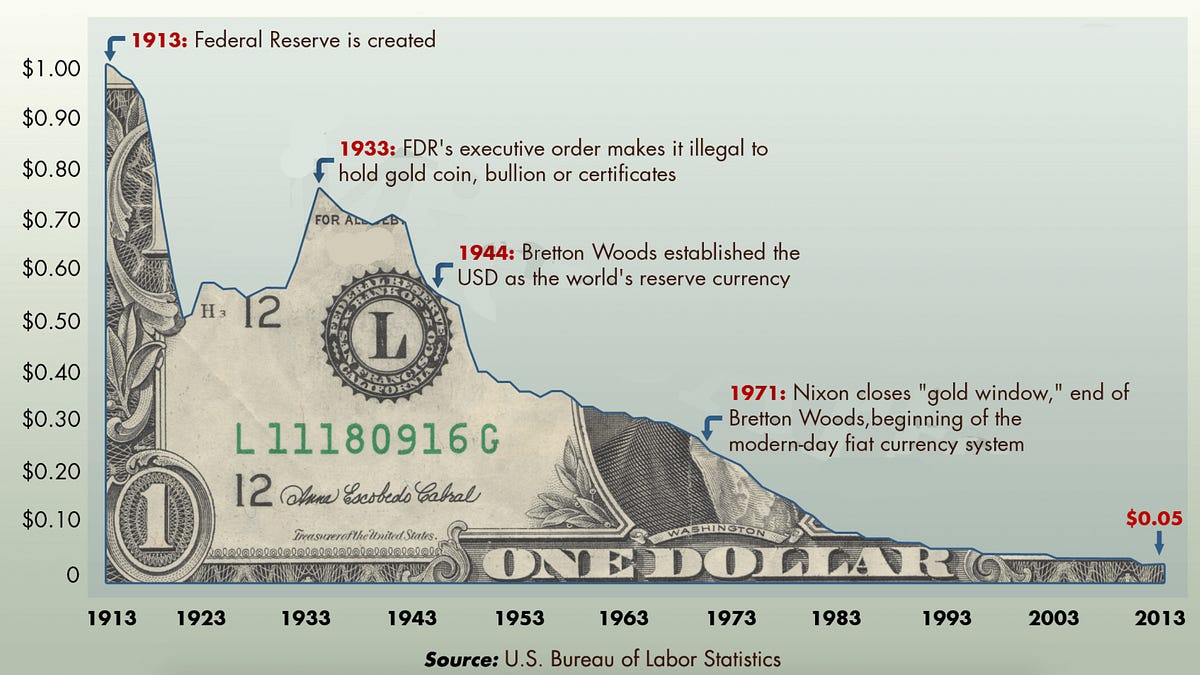

Even if Tether were 100% backed by USD…what are dollars? No longer 1/20 oz of gold. They are digital nothing that can be counterfeit ad infinitum by banks, to steal your time. We are in a period in history when you can trade worthless, infinite digital tokens for valuable, scarce ones. This is only possible, because of information asymmetry…if everyone had perfect information, no amount of dollars could buy 1 bitcoin.

The more fiat is created to buy bitcoin (fake fiat? It’s all fake!), the more fiat collapses.