Yeah that’s why I pointed out that possibility in my first post dudeIt's only really a "stop" if they do not buy any more for years.

Also, they may be waiting for the price to go down before buying again.

Wouldn't you do the same ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Precious Metals

- Thread starter president

- Start date

Of course it does. It may be small or incremental, but it's has the stock to flow of a historical commodity. In other words, over time, since its supply increases, it is worth less compared to a given standard that doesn't change (much).The real value of gold DOES NOT CHANGE over time.

Yes gold supply rises on average by about 1 - 2% per annum but the worlds population so far at least continues to grow as does total production/gdp over time therefore 2% increase in supply doesn’t correlate to 2% loss in purchasing power. I think you are oversimplifying the situationOf course it does. It may be small or incremental, but it's has the stock to flow of a historical commodity. In other words, over time, since its supply increases, it is worth less compared to a given standard that doesn't change (much).

That's why I compared it to a given standard. What's more, now that BTC is on the scene, of course it is worth much less. While it may go up in this instability period, it is going up less than it would have, and that will only also increase with time. Diminishing returns kind of thingYes gold supply rises on average by about 1 - 2% per annum but the worlds population so far at least continues to grow as does total production/gdp over time therefore 2% increase in supply doesn’t correlate to 2% loss in purchasing power. I think you are oversimplifying the situation

Central banks buying gold means that we are in times of major confidence loss. You'll do well with it, just be careful with "miners".

Central banks buying gold means that we are in times of major confidence loss. You'll do well with it, just be careful with "miners".

It also could mean the majority of the countries of the world will all soon jointly agree to re-value all gold in the world to a much higher rate to pay off all their debts and/or increase their nation's overall wealth.

Yes it could, they are both happening, as it turns out. The confidence loss is in the deepest, most liquid "asset", which is strategic as well, the US Treasury market.It also could mean the majority of the countries of the world will all soon jointly agree to re-value all gold in the world to a much higher rate to pay off all their debts and/or increase their nation's overall wealth.

Silver still hovering around $30+ an ounce and becoming even further detached from gold. I traded alot of my silver in awhile back but will probably grab a few 10oz bars here soon. I think precious metals will dip early in Trump II due to other investments being attractive like energy and crypto. I've grabbed shares of Exxon/Mobil over the last 2 weeks and been glad I did. Picking up some bulk pre-1965 "junk" silver coins wouldn't be a bad idea either if it dips.

One more thing.., in 1964 a loaf of bread was about 20 cents or two silver dimes. In my area in 2025 a loaf of bread is about $4, or roughly two 1964 silver dimes. interesting...

One more thing.., in 1964 a loaf of bread was about 20 cents or two silver dimes. In my area in 2025 a loaf of bread is about $4, or roughly two 1964 silver dimes. interesting...

Last edited:

It’s works out about the same for a gallon of gas. That’s why owning metals Is such a good idea, to conserve your money. Important to remember that they aren’t going up in value it’s just the dollar is dropping so fast.One more thing.., in 1964 a loaf of bread was about 20 cents or two silver dimes. In my area in 2025 a loaf of bread is about $4, or roughly two 1964 silver dimes. interesting...

... in 1964 a loaf of bread was about 20 cents or two silver dimes. In my area in 2025 a loaf of bread is about $4, or roughly two 1964 silver dimes.

Exactly... physical possession of silver and gold are solid, low risk investments.It’s works out about the same for a gallon of gas...

The dollar is dropping but if you're doing the right thing business/work wise you are being paid more of them.... That’s why owning metals Is such a good idea... Important to remember that they aren’t going up in value it’s just the dollar is dropping so fast.

In 1995 bread was $2 a loaf and I was making $15 an hour, bread is now $4 a loaf and I'm making $50 an hour (for easier more fulfilling work), so for me bread is cheaper in 2025 than it was in 1995.

Yeah because you moved up to doing a higher level of work. If you did the exact same work as you did in 1995 you would probably only be making $25 per hour or something like that and the $4 loaf of bread today would be lower quality. The equivalent of a 1995 loaf of bread would be a $6 loaf of bread from a hipster artisan bakery.Exactly... physical possession of silver and gold are solid, low risk investments.

The dollar is dropping but if you're doing the right thing business/work wise you are being paid more of them.

In 1995 bread was $2 a loaf and I was making $15 an hour, bread is now $4 a loaf and I'm making $50 an hour (for easier more fulfilling work), so for me bread is cheaper in 2025 than it was in 1995.

Trump defending the USD (understandable and predictable) against BRICS:

Shryver is implying that BRICS countries are unloading USD for PMs (signaling a gold-backed/linked BRICS-buck?). They've taken their measure of the US and may have found us lacking (or at least a weak spot).

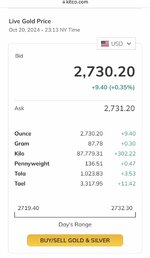

PMs had a very solid 2024 (little drawback end of year) and are off to a decent 2025 start. Tariffs threaten to bifurcate the world economy, which might accelerate BRICS movement. Devaluing the dollar (to boost exports) is usually a net positive for PMs. Strangely enough, 2024 saw a strong PM gain - even while the USD gained. Is that magic running out? Is the dollar on a sugar high as it is safer than other traditional fiats, for now?

This will be a test of Trump's will (very high) and the remaining measure of American economic dominance (still very high but in retreat/stagnate).

Worth noting that all last year, as local and ATHs were reported, PM bugs would get excited, with the occasional guy calling "it's happening, to the moon." Of course, the moon shot never materialized, there was usually a pullback, but then more gain (best year PMs have had in a long time). The bankers still have a strong short game, but they are crushing less than before. It does lend credence to the "last call" theory. Banks better cover shorts, now, and accumulate (or at least get away from short exposure). Clock's ticking.

Shryver is implying that BRICS countries are unloading USD for PMs (signaling a gold-backed/linked BRICS-buck?). They've taken their measure of the US and may have found us lacking (or at least a weak spot).

PMs had a very solid 2024 (little drawback end of year) and are off to a decent 2025 start. Tariffs threaten to bifurcate the world economy, which might accelerate BRICS movement. Devaluing the dollar (to boost exports) is usually a net positive for PMs. Strangely enough, 2024 saw a strong PM gain - even while the USD gained. Is that magic running out? Is the dollar on a sugar high as it is safer than other traditional fiats, for now?

This will be a test of Trump's will (very high) and the remaining measure of American economic dominance (still very high but in retreat/stagnate).

Worth noting that all last year, as local and ATHs were reported, PM bugs would get excited, with the occasional guy calling "it's happening, to the moon." Of course, the moon shot never materialized, there was usually a pullback, but then more gain (best year PMs have had in a long time). The bankers still have a strong short game, but they are crushing less than before. It does lend credence to the "last call" theory. Banks better cover shorts, now, and accumulate (or at least get away from short exposure). Clock's ticking.

Trump's logic is the opposite of reality. In reality it is the rest of the world that are suckers for accepting worthless US dollar fiat (the U.S. trade deficit) in exchange for the goods they produce. Even if those other countries lose the U.S. market as customers its okay if they end up instead selling those goods to other markets which don't have massive trade deficits and actually give them other goods in exchange for their goods instead of worthless fiat.

I've used JMBullion to much success. Great customer service and easy delivery. One aspect of this that I would encourage you all to think bout is what happens if gold is banned again in this country. Believe it or not, Gold ownership was once banned within this country. When societies rapidly deflate their currency, capitol controls (which is what a ban on gold ownership is) are always necessary due to Gresham's Law.So to buy physical gold or silver (or copper?) is it best to buy off AMPEX online and have it delivered or go to your local gold/silver exchange shop? I stopped in one about a year or so ago and didn’t like their fee up charges over spot.

Any investor in PM's does so because of their philosophy regarding what currency is, and how to preserve wealth. And this philosophy usually has a longer-term mindset. So, what is the stance of our own government in the long term? Will capitol controls come back to this country as we move toward a fiscal dominant minatory environment (for information on what that is, Lyn Alden is phenomenal: https://www.lynalden.com/full-steam-ahead-all-aboard-fiscal-dominance/)

And if that happens, will the government go after people who have invested in Gold? In that case, buying cash for gold now is a solid way to hedge against the predations of our own government. Yes, I currently use the internet but as our fiscal environment rapidly changes, I'm going to start looking at purchasing PM's in a manner that cannot be tracked. Maybe I have a tin-hat on... But I wouldn't put it beyond our wicked government to look at online purchase history in the future. So all that being said, the TLDR version is I think its great to purchase online right now, but shifting toward a cash-buy only strategy is increasingly become attractive to me.

Something is going on with gold in London. Something about a run on gold there. Does anyone have a good summary of the situation? Apparently it's a pretty big deal.

Something is going on with gold in London. Something about a run on gold there. Does anyone have a good summary of the situation? Apparently it's a pretty big deal.

This article gives some details

Trump tariffs: Why is JPMorgan flying gold from London to NYC? | Fortune

Fears that Trump could impose a blanket tax on all imports from Europe, including gold, has prompted a massive influx of the metal into the U.S.

This video also covers some speculation

At minute 9:42 in the video they go into detail about the London situation.

Last edited:

This article gives some details

Trump tariffs: Why is JPMorgan flying gold from London to NYC? | Fortune

Fears that Trump could impose a blanket tax on all imports from Europe, including gold, has prompted a massive influx of the metal into the U.S.fortune.com

This video also covers some speculation

At minute 9:42 in the video they go into detail about the London situation.

There was talk a while back of phantom gold, where people sold ownership of gold on paper, while keeping it stored in their vault for safety, but sold more than what they physically had available. The fear was that this shortfall would be exposed, and there would be a run on gold, with everyone wanting to trade their paper stocks for physical gold.

With this situation, and with talk of having DOGE audit Fort Knox, I wonder if this run is starting. Maybe we'll see this house of cards collapse!

The tweet I posted above had McGregor saying that the UK might not survive. Big if so!

The politics of gold

Why has the price of gold been increasing so fast, breaking records? Economist Michael Hudson explains the politics of the precious metal, and the dynamics of the US dollar system. <a href='https://youtu.be/9Bvr2SZm-NM' title='https://youtu.be/9Bvr2SZm-NM' >https://youtu.be/9Bvr2SZm-NM</a>...